Market Review for Friday

n Friday, the US dollar turned decisively lower, in a clear technical failure to break to new recent highs. Prices fell fairly steeply, and it now looks like the greenback has had an important technical failure and now needs to return to test support. If it breaks below those levels, technical traders will see a double top on the charts, in a market in which one can easily paint a bearish fundamental picture. Equities were higher, as well, although many investors remained on the sidelines waiting for this coming week’s quarterly profit numbers. These factors, especially working in tandem, should have been able to push oil quotes higher on Friday. The fact that they did not was noteworthy and suggests a change in focus.

It was nonetheless surprising to see oil prices working lower. The oil complex posted its third straight day of losses on Friday, and traders were talking about fundamentals - and it was their selling which dominated trading. That is unusual, although not unique, over the last 14 months.

Traders noted this week that the healthiest supply picture was in gasoline, where inventories are only 5.9 million barrels (2.72%) higher than a year ago - while last year they were 3.1 million barrels (1.41%) lower than the previous year. Crude oil and distillate stocks are much nearer, or even below, year-ago levels (crude is down 9.8 mln bbls, distillate up 1.9 mln bbls, against a year ago), but both had huge surpluses a year ago (crude was 47.6 mln bbls higher, distillate stocks were 33.7 mln bbls higher). While gasoline stocks are much closer to the levels seen last year and the year before that, the problem with gasoline inventories is that they are near 17-year highs. And they represent the bulls’ best hope.

All of which explains Friday’s weakness. Of course, none of this is really new. The reduction in total oil demand (from a four-week average of up 3.61% two weeks ago to up just 1.92% in the latest report) is reasonably fresh, but we have known for a while now that oil stocks are plentiful. What is new, though, is the market’s preference to reflect fundamentals rather than higher equities or a lower dollar. If the bulls cannot reverse that and get prices to resume their upward trend based on these outside influences, it will become plain that oil prices are far too high, even after three days of movement lower.

This next week, we will get a fresh look at retail sales, consumer confidence, industrial production and the first quarter profit pictures for a number of companies. If oil markets continue to take cues from supply and demand – in preference to the dollar, equities or economic data – we cannot paint a picture that includes higher prices.

Courtesy Peter Beutel

Technical Recap

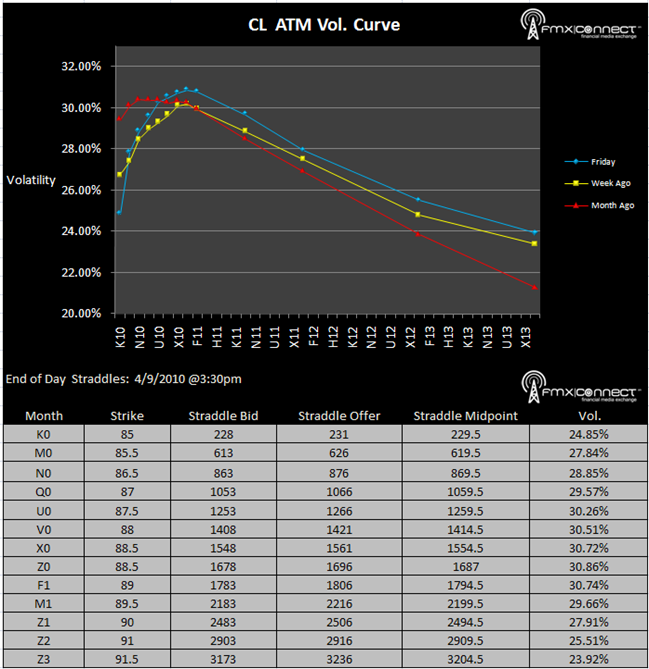

Volatility Term Structure

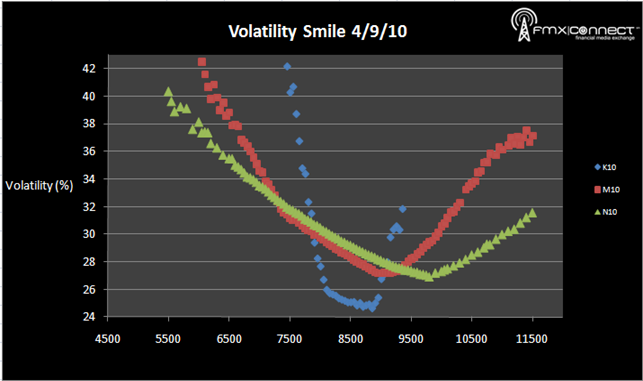

Volatility Smile

***From NYMEX Settlements

Significant Activity:

1. M10 8000 P

2. K10 8000 P

3. M10 7500 P

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements