Oil Petrospectives: Formerly Oil & Products Daily

ednesday was an active day, and traders had a good deal more to think about. The biggest factor was this week’s Department of Energy (DOE) report, which showed a smaller drawdown in crude oil stocks than the API report had shown, but one that was still larger than the average estimates of the wire service surveys. The change in crude oil inventories has become sort of the “standard-bearer” of each week’s statistics, and the drawdown gave the re[port a bullish flavor that quickly translated into higher oil prices. These were supported through the Nymex close by stronger equities and a stronger euro. Neither of those could finish on a strong note, though. This week’s DOE statistical survey showed a drawdown in crude oil stocks of 1.829 million barrels. Distillate stocks increased by 1.836 million barrels, while gasoline stocks fell by 0.008 million barrels. The DOE report also showed a bigger increase in refinery utilization, which it had up 1.6%, as opposed to the API report’s increase of 0.2%. Utilization often increases into Independence Day, and it may follow that pattern this year.

It was the first case ob back-to-back crude oil stock draws in a row since January, and that suggested to traders that recently burdensome inventories may be starting to diminish. Of course, crude oil stocks, now 200,000 barrels (0.06%) below year-ago figures, are still an astonishing 59.2 million barrels (19.59%) higher than they were two years ago this week. And, at some point, higher utilization could just be turning high crude oil stocks into even higher refined products stocks.

Distillate stocks are now only 5.1 million barrels higher than they were a year ago. But they are 40.8 million bbls more than in 2008 (35.78%). Gasoline stocks, which are only 8.9 million bbls higher than they were two years ago, are 17.4 million bbls (8.63%) higher than they were a year ago.

Four-week demand remained relatively robust, although almost every single product saw its year-on-year percentage increase down from a week ago. Total products supplied were up 7.26% against a year ago, but had been up 8.12% a week ago. Four-week distillate demand is now up 12.14%, but was up 17.06% a week ago. And four-week gasoline demand has turned negative, and is now 1.01% lower than a year ago, compared to having been up 0.48% a week ago.

It was seen as being a bullish DOE report, and we think it was. But, the oil markets are not only influenced by supply and demand factors and more investment-inclined buyers in the oil markets are sure to feel exposed by Wednesday’s late slide in both the euro and in equities. After having been well into positive territory just before noon, the DJIA fell from its high then to finish down 40.73 points at 9899.25. And the euro, so desperate for any strength at all, dropped from its pre-noon high to finish below $1.20 per euro. This weakness in two widely-watched outside influences could affect oil prices overnight and into Thursday.

Courtesy Cameron Hanover

***From NYMEX Settlements

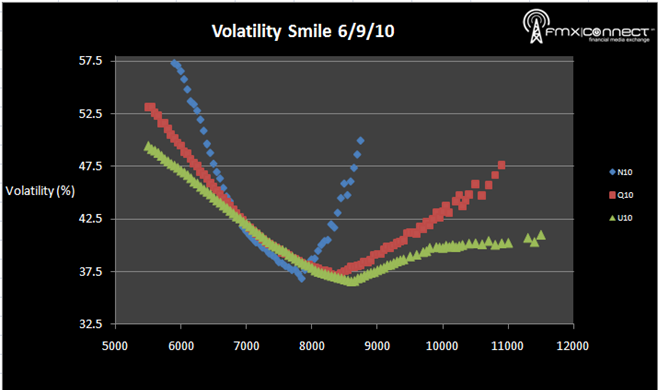

1. Z10 8500 C.

2. Z10 8000 C.

3. Q10 7500 C.

Premium Subscribers (click here to register):

Volumes & Open Interest

End Of Day Straddles

Trade Blotter

Settlements